Discover four most common HR compliance issues small businesses face - and learn how to effectively deal with them! Check out these pro tips to and learn how to keep your small business on the right side of the law.

Discover four most common HR compliance issues small businesses face - and learn how to effectively deal with them! Check out these pro tips to and learn how to keep your small business on the right side of the law.

Human resources plays a huge role in shaping your small business. HR functions help to keep your business compliant, and importantly, keep your employees happy.

But, keeping up with HR regulations is extremely daunting – especially with already limited resources. Not everyone has the budget for a full-time HR professional on staff, and almost no business owner has the time to become an expert himself.

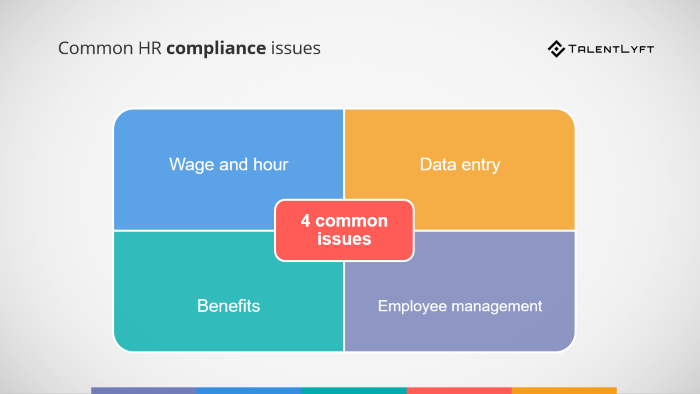

However, with a bit of education, you can combat these four common HR compliance issues to keep your small business on the right side of the law.

➡️ Download our free eBook: GDPR Compliance in Human Resources!

Here are the 4 common HR compliance issues - and tips to handle them like a pro!

One of the most common issues businesses face is how to properly classify and pay employees. Get this distinction wrong and it could really cost you.

Generally speaking, an employee is someone who fills out a Form W-4 upon hiring and someone whom you provide a Form W-2 come tax time.

Separately, an independent contractor will provide a Form W-9 at the time of hire and you’ll provide a Form 1099 at tax time.

Also, employees are covered by federal state employment and labor laws, but contractors are not. You’ll want to take the time to read up on this via the IRS.

Other wage-related compliance issues to consider:

Minimum wage updates

While the federal minimum wage has held steady since 2009, there are always state and local jurisdictions that set their own rates. If your business operates in a few different locations, this can be especially hard to keep up with.

Overtime

While regulations continue to be a point of discussion on the national level, some rules vary by state. So, it’s important to manage your scheduling to control any additional costs.

Work scheduling and hiring minors

Educate yourself on the laws for providing time off for employees’ personal needs, work permits, and scheduling for minors.

Meals and rest breaks

The rules relating to meal breaks and rest periods vary by state. Violations of these rules can result in additional overtime pay and penalties.

➡️ How to mitigate wage and hour risks:

Create an employee handbook that includes applicable policies.

Maintain an updated compliance calendar with all posting, notification, and filing deadlines.

Ensure that payroll and benefits tracking systems are in place to properly record and report work hours, time off, and other employee payments or deductions.

Train supervisors on nondiscrimination practices, proper time tracking, and other employment policies.

Accuracy is always critical when it comes to performing a job effectively, but when it comes to handling important employee data, the details really do matter.

Whether you’ve implemented a digital onboarding platform, or are still using hard copies of paperwork, entering the data accurately ensures that the right information is stored – saving you and your employees the hassle of mistakes later on.

➡️ How to avoid data entry woes:

Have someone check your work. Then, have them check it again.

According to the AICPA, 80% of workers would keep a job with benefits rather than take one that offered more pay and no benefits. We all know the race for top talent is tight, so it’s important that small business owners recognize the value in offering benefits to employees.

Benefits do bring on their own challenges though. Rising costs, administration, and ever-changing legislation.

Here are a few common compliance challenges associated with benefits:

Paid sick leave

More and more states are passing robust paid sick leave regulations. The requirements and reporting vary by location, so you must pay close attention to the laws in your area.

Family and Medical Leave Act (FMLA)

As a refresher, FMLA allows eligible employees of covered employers to take unpaid, but job-protected leave for specified family and medical reasons. It also requires that employee get continuation of group health insurance coverage under the same terms and conditions as if the employee had not taken leave. It’s difficult to coordinate proper notification of eligibility for leaves, designation of the time off, managing benefits communications and so on.

Employee Retirement Income Security Act (ERISA)

ERISA is a federal law that sets minimum standards for retirement and health benefit plans regarding: standards of conduct, fiduciary rules, and reporting requirements to the government and plan participants. Failure to comply with ERISA can cost your business thousands in penalties.

Consolidated Omnibus Budget Reconciliation Act (COBRA)

COBRA provides employees and dependents who lost health care benefits the option to continue coverage. For this law, you’re required to comply with notifications and administration of federal COBRA and state COBRA rules.

➡️ Ways to stay compliant:

Work closely with a broker or payroll provider to ensure employees are enrolled properly.

Review your benefits programs annually.

Establish new hire and termination processes.

Review and communicate all of your benefits offerings.

Without your employees, where would your business be? You need productive and engaged employees in order to thrive.

According to a recent Gallup survey, 53% of employees are disengaged at work and each disengaged employee will cost you.

The same survey concludes it will cost you 34% of their salary (due to loss of productivity, missed shifts, negative attitude, etc.).

Employee management is one HR compliance factor you can’t ignore. So what does this mean? This concept includes everything from managing performance, employee training, discipline, and termination.

One way you can improve employee engagement is to conduct periodic performance reviews so that you can keep a pulse on how your employees are feeling. They are great for career development, recognition, and feedback.

Placing a focus on employee management does take a lot of your time, but it will be well worth it. Just be sure that whatever processes you implement are free from any discrimination issues.

➡️ Best practices for employee management:

Establish measurable work performance objectives.

Provide regular performance feedback.

Create recognition programs.

Train supervisors or managers constantly - not just for compliance, but for communications.

Review disciplinary processes.

HR compliance must be a top priority. As always, it’s best for small business owners to consult with a trusted advisor before making any decisions when it comes to HR. But a little knowledge does go a long way. Use the tips above to avoid any costly penalties associated with HR compliance issues.

Rachel is the Corporate Communications Specialist for PrimePay. Before starting her career in the marketing world, she worked for a local TV news station writing for the website and handling the station’s social media platforms.

A creative writer at heart, Rachel loves to insert her style into any of the copy she creates. Outside of work, you can find Rachel playing soccer, or cheering on her Steelers with a Starbucks in hand.

![[GUIDE] How to Segment Your Talent Pool](https://adoptostaging.blob.core.windows.net/article/0pOm3nwXhEm6SEPThfIO2Q.png?8619)